When it comes to seeking funding, every entrepreneur knows that preparation is key. That’s why understanding these preparation tips for startups looking to pitch for funding opportunities in India can make all the difference in your fundraising journey. With the Indian startup ecosystem rapidly evolving, securing investment has become both a thrilling and daunting task. Did you know that India ranks among the top countries for startup funding, attracting billions in venture capital every year? However, the competition is fierce, and investors are inundated with pitches from eager entrepreneurs. So, how do you ensure that your pitch stands out? This guide will equip you with essential strategies and actionable insights to effectively prepare for your funding journey, enabling you to captivate investors and propel your startup to new heights.

Understanding the Funding Landscape in India

The first step in your journey as a startup is to gain a comprehensive understanding of the funding landscape in India. This knowledge will not only equip you with essential insights but also strengthen your pitch when presenting to potential investors.

Overview of funding opportunities for startups

India has a vibrant startup ecosystem, ripe with numerous funding opportunities. Startups can explore various avenues for investment, each offering unique benefits. Here are some of the most common sources of funding:

-

Angel Investors: High-net-worth individuals who provide capital in exchange for equity. They often bring valuable mentorship.

-

Venture Capitalists (VCs): Professional investors who manage pooled funds to invest in startups with high growth potential.

-

Crowdfunding: Platforms like Kickstarter or Indiegogo allow startups to raise small amounts of money from many people.

-

Incubators and Accelerators: Organizations that provide support, mentorship, and sometimes funding to help startups grow.

Types of investors: Angels, VCs, and crowdfunding

Understanding the distinct characteristics of each investor type can greatly enhance your chances during the pitching process. Here’s a closer look:

-

Angel Investors

-

Typically invest in the early stages of a startup.

-

Smaller amounts compared to VCs but often more flexible.

-

Look for passionate founders and innovative ideas.

-

-

Venture Capitalists

-

Focus on startups with proven traction.

-

Tend to invest larger sums than angel investors.

-

They often seek a return on investment (ROI) within a specific timeframe.

-

-

Crowdfunding

-

Involves raising funds from a large number of individuals via online platforms.

-

Ideal for consumer-focused startups with a strong value proposition.

-

Provides a marketing boost and validation as many backers are also potential customers.

-

Familiarity with these funding sources is among the key preparation tips for startups looking to pitch for funding opportunities in India. The more you understand your audience—in this case, the investors—the better equipped you will be to tailor your pitch effectively.

For more insights on investor relations, you may explore resources from Nasscom, a leading trade body for the technology industry in India.

Essential Pre-Pitch Research

Before approaching potential investors, conducting thorough pre-pitch research is crucial. This foundational step not only builds your confidence but also enhances your credibility as an entrepreneur seeking funding.

Identifying the right investors for your startup

It's essential to align your startup with investors who share your vision and investment goals. The following criteria can help you identify the most suitable investors:

-

Industry Focus: Seek investors specializing in your industry, be it technology, healthcare, or consumer goods.

-

Investment Stage: Some investors prefer early-stage companies, while others focus on scaling businesses. Understanding their stage preferences can streamline your search.

-

Geographic Preference: Many investors have a regional focus. Target those who invest in startups based in India or specific cities where you operate.

Analyzing investor preferences and past investments

Equipped with insights about potential investors, delve deeper by examining their previous investments:

-

Portfolio Companies: Research companies they have previously funded to gauge their interests and investment patterns.

-

Funding Amounts: Note the typical funding amounts these investors allocate—this helps you prepare your own funding request.

-

Success Stories: Look for any notable exits or successes in their portfolio, which can serve as good conversation starters during your pitch.

Market research: Knowing your industry and competitors

A well-informed pitch is compelling. Conduct extensive market research to understand both your industry landscape and your competitors:

-

Industry Trends: Stay updated on emerging trends that could affect your startup's growth.

-

Competitor Analysis: Analyze at least three to five competitors, highlighting their strengths and weaknesses. This data can showcase your startup's unique selling point.

-

Customer Insights: Gather information on customer pain points and preferences. This enhances your pitch by illustrating market demand for your solution.

By leveraging these essential preparation tips for startups looking to pitch for funding opportunities in India, you'll be better equipped to impress potential investors with a well-rounded and informed proposition.

For further resources on understanding investors, consider exploring the offerings of Sequoia Capital, a leading venture capital firm known for its work with innovative startups.

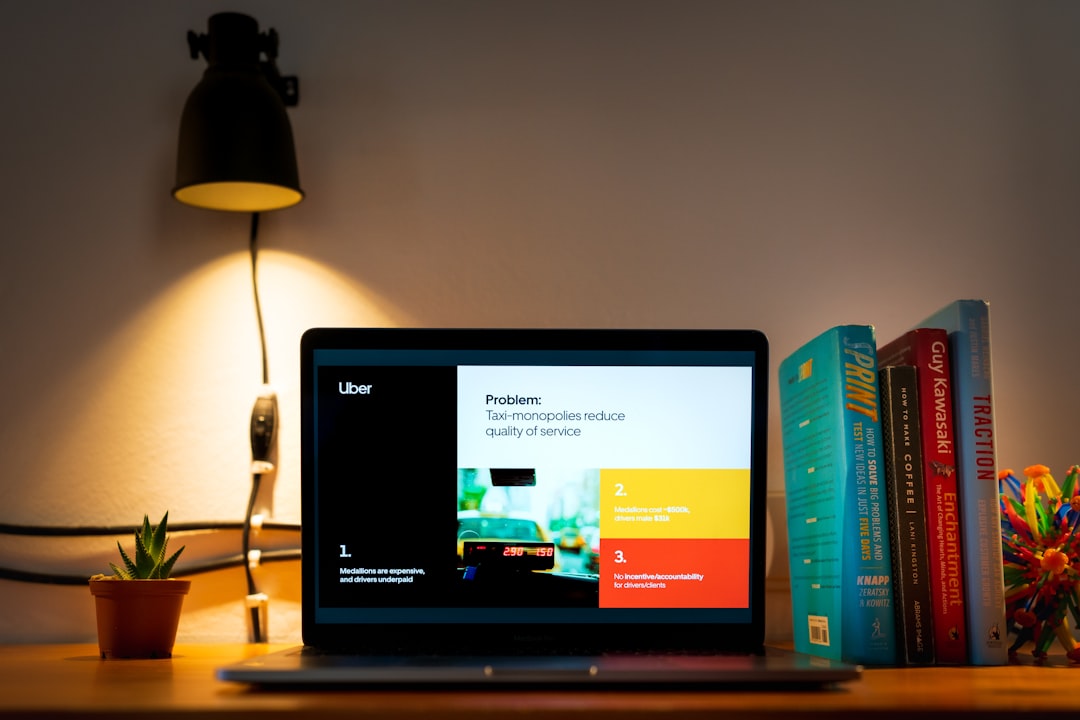

Crafting a Compelling Pitch Deck

A well-crafted pitch deck is essential in making a memorable first impression on potential investors. It serves as a visual representation of your startup and the opportunity you present, making it pivotal in conveying your message effectively.

Key components of an effective pitch deck

To ensure your pitch deck resonates with investors, incorporate the following crucial elements:

-

Introduction Slide: Start with your company name, logo, and a tagline that summarizes your mission.

-

Problem Statement: Clearly articulate the problem your startup aims to solve. Use relatable scenarios to emphasize its significance.

-

Solution Overview: Describe how your product or service effectively addresses the outlined problem, highlighting unique features.

-

Market Opportunity: Present data on market size and growth potential to demonstrate demand for your solution.

-

Business Model: Explain how your startup plans to make money, detailing revenue streams and pricing strategies.

-

Traction: Showcase any achievements, such as user statistics, partnerships, or financial projections that illustrate growth.

-

Team: Introduce your founding team, emphasizing their expertise and roles, as investors often invest in people as much as in ideas.

-

Financial Projections: Include key financial metrics and future projections to assure investors of your startup's viability.

-

Closing Statement: Conclude with a compelling call-to-action, inviting investors to join you on your journey.

Visual design tips for maximizing impact

An impactful pitch deck is not just about information—design matters too. Employ these visual design tips to enhance your presentation:

-

Consistent Branding: Use a consistent color scheme and font style that aligns with your startup’s branding.

-

Minimal Text: Keep slides uncluttered. Use bullet points and visuals to convey information succinctly.

-

High-Quality Images: Incorporate relevant graphs, charts, and images to support your narrative and capture attention.

-

Engaging Fonts: Select easy-to-read fonts that maintain professionalism while being visually appealing.

Tailoring your message to resonate with investors

Ensure you address what matters most to your audience. Tailor your pitch to emphasize aspects that align with the specific interests of the investors you are targeting.

By integrating these preparation tips for startups looking to pitch for funding opportunities in India into your pitch deck, you can enhance your chances of making a lasting impression and securing investment.

For further guidance on creating effective pitch decks, consider checking resources from Canva, a popular platform for designing engaging presentations.

Developing a Solid Business Model

A strong business model is the backbone of any successful startup. When pitching for funding, it's essential to articulate clearly how your startup will operate and generate revenue. Investors often look for well-defined business models that indicate sustainability and growth potential.

Importance of a well-defined business plan

A business plan serves as the blueprint for your startup. It outlines your vision, strategies, and the steps needed to achieve your goals. Here’s why having a concise and effective business plan is critical:

-

Clarity of Vision: It helps clarify your objectives and strategies, serving as a guide for your startup's journey.

-

Investor Confidence: A well-structured plan demonstrates to investors that you have thoughtfully considered operational and growth strategies.

-

Risk Mitigation: Identifying potential obstacles and developing contingency measures showcases your proactive approach.

Key elements to include in your business model

When developing your business model, ensure it encompasses the following components:

-

Value Proposition: Clearly state what differentiates your product or service. What unique value do you offer to customers?

-

Target Market: Define your ideal customer segments. Who benefits most from your solution?

-

Revenue Streams: Detail how you intend to generate revenue, including pricing strategies, sales channels, and any subscriptions or licensing agreements.

-

Cost Structure: Outline the primary costs associated with running your business. This includes fixed and variable costs.

-

Key Partnerships: Identify any strategic partnerships that can enhance your product offering or expand your market reach.

Highlighting unique value propositions

Investors want to know what sets your startup apart from the competition. To strengthen your pitch:

-

Conduct Competitive Analysis: Identify your main competitors and assess their strengths and weaknesses compared to your offering.

-

Demonstrate Traction: If applicable, share data on customer acquisition, retention, and any other metrics that show market demand.

-

Share Customer Testimonials: Real-world feedback provides third-party validation and reinforces your value proposition.

By developing a solid business model and integrating these preparation tips for startups looking to pitch for funding opportunities in India, you can significantly increase your appeal to potential investors and demonstrate the viability of your venture.

For further insights into building effective business models, you may want to explore resources offered by Harvard Business Review, renowned for its contributions to management and business theory.

Practicing Your Delivery

Delivering your pitch effectively is as important as the content of your presentation. A great idea can be overshadowed by poor delivery, so investing time in practice is essential. This section outlines key strategies to ensure you present your startup well and connect with your audience.

Rehearsing your pitch for confidence

Practice makes perfect. Rehearsing your pitch can significantly increase your confidence and polish your delivery. Here’s how you can maximize your practice sessions:

-

Create a Consistent Script: Develop a script that outlines your key points but allows for flexibility. Aim to communicate naturally rather than relying solely on memorization.

-

Time Your Presentation: Ensure your pitch fits within the allotted time. A concise presentation usually resonates better with investors.

-

Practice in Front of Others: Gather a small group of mentors, peers, or friends to listen to your pitch. Constructive feedback can provide valuable insights and help you improve.

Handling Q&A sessions effectively

Investors will likely have questions, and how you handle them can make or break your pitch. Here are some tips for managing Q&A sessions:

-

Anticipate Common Questions: Prepare for frequently asked questions related to your business model, market strategy, or financial projections.

-

Stay Calm and Composed: If you encounter a challenging question, take a moment to think before responding. It’s better to give a well-thought-out answer than to rush.

-

Be Honest: If you don’t know the answer to a question, it’s better to admit it rather than to make something up. Offer to follow up with the information later.

Importance of storytelling in pitches

Incorporating storytelling into your pitch can create emotional connections with your audience. Consider the following:

-

Engage Your Audience: Start with a personal story or a compelling anecdote related to your startup that illustrates the problem you are solving.

-

Build a Narrative Arc: Structure your presentation like a story, with a beginning (problem), a middle (solution), and an end (vision for the future).

-

Visualize Success: Paint a picture of what success looks like for your startup, allowing investors to visualize their role in your journey.

By integrating these practice-focused preparation tips for startups looking to pitch for funding opportunities in India, you can enhance your delivery and foster a deeper connection with your potential investors, increasing the likelihood of a successful funding round.

For more resources on effective public speaking, consider visiting Toastmasters International, an organization focused on improving communication and leadership skills.

Preparing for Investor Insights

Being well-prepared to engage with potential investors goes beyond simply delivering your pitch. Understanding what investors are likely to ask and how to respond can significantly impact your chances of success. This section will guide you through how to effectively prepare for investor insights and inquiries.

Anticipating potential investor questions

Investors will scrutinize various aspects of your startup during the pitch. Here are common questions they may ask, and how to prepare for them:

-

Market Validation: "How do you know there's a demand for your product?"

-

Prepare statistics and market research that substantiate your claims about customer interest.

-

-

Revenue Projections: "What are your financial projections for the next three to five years?"

-

Offer clear, realistic projections backed by solid data and a rationale for how you arrived at those figures.

-

-

Competitive Landscape: "Who are your main competitors, and what differentiates you from them?"

-

Have a comparative analysis ready that highlights your unique selling propositions.

-

Strengthening your answers with data

To make your answers convincing, use data effectively. Consider the following tips:

-

Back Up Claims: Use charts, graphs, and statistics to support your answers and demonstrate credibility.

-

Real-World Examples: Mention case studies or successful precedents that validate your approach, giving investors reassurance about your venture.

-

Be Prepared with Documentation: Have additional documents or appendices prepared that detail your market research, financial models, or other pertinent information.

Demonstrating knowledge of industry trends

Investors appreciate entrepreneurs who are not only focused on their startup but are also aware of broader industry trends that could impact their business. To showcase this knowledge:

-

Stay Updated: Regularly read industry reports, articles, and news related to your market.

-

Include Industry Insights: Reference current trends during your pitch that align with your business model, demonstrating foresight and adaptability.

By preparing thoroughly to handle investor inquiries, you will exhibit confidence and create deeper trust with potential backers. This approach is a vital part of the preparation tips for startups looking to pitch for funding opportunities in India, preparing you to engage meaningfully with investors and respond adeptly to their concerns.

For further insights on preparing for investor discussions, you can explore resources from Crunchbase, which provides information on businesses, funding, and industry insights.

Building Investor Relationships

Establishing strong relationships with investors can significantly enhance your chances of securing funding for your startup. Building these connections is a long-term strategy that goes beyond the immediate pitch. This section outlines strategies to cultivate investor relationships that can benefit your startup.

Networking strategies before your pitch

Networking lays the foundation for potential investment opportunities. Here are effective ways to build your network:

-

Attend Startup Events: Participate in startup competitions, trade shows, and networking events. These venues often attract investors looking for new projects.

-

Engage with Online Communities: Utilize platforms like LinkedIn, startup forums, and social media groups to connect with potential investors and mentor figures.

-

Seek Warm Introductions: Leverage your existing network to gain introductions to investors. A warm introduction can significantly enhance your credibility.

Importance of follow-ups and maintaining connections

Once you’ve made initial contact with investors, it’s crucial to maintain those relationships. Consider the following strategies for effective follow-up:

-

Send Thank-You Notes: After meetings or pitches, sending a thoughtful thank-you note can leave a positive impression and open doors for future interactions.

-

Provide Regular Updates: Keep investors informed about your startup's progress—even if they didn’t invest. This can establish goodwill and keep them interested in your journey.

-

Engage on Social Media: Follow investors on platforms like Twitter and LinkedIn. Like or comment on their posts thoughtfully to keep the relationship alive.

Leveraging social media for outreach

In today’s digital age, social media offers unique opportunities to connect with investors. Here’s how you can utilize it effectively:

-

Create a Professional Profile: Ensure your social media profiles represent your startup professionally, showcasing your mission and goals.

-

Share Valuable Content: Post articles, insights, and updates about your startup or industry trends. This positions you as a thought leader and makes you more noticeable to potential investors.

-

Engage with Investor Content: Actively interact with investors by commenting on their posts or sharing their content, which can lead to meaningful conversations.

By focusing on these relationship-building strategies, you will enhance your visibility and reputation among potential investors, increasing the likelihood of securing funding. These preparation tips for startups looking to pitch for funding opportunities in India ensure that you have a strategic approach to not just your pitch, but to fostering lasting partnerships.

For more insights on startup networking and relationship management, consider visiting Meetup, a platform designed to connect individuals with shared interests and foster community-building, including startups and investors.

Legal and Document Preparation

Before you pitch to potential investors, having all your legal documents and relevant paperwork in order is essential. This not only demonstrates professionalism but also prepares you for questions regarding the legitimacy and structure of your startup. This section discusses the key legal documents you should prepare and the importance of transparency.

Necessary legal documents to have ready

Investors will likely ask to see various legal documents to assess the credibility of your startup. Here’s a list of crucial documents you should prepare:

-

Business Registration Documents: Include your certificate of incorporation, which verifies your startup's legal status.

-

Shareholder Agreements: Detail the rights and obligations of your stakeholders to clarify ownership stakes and control mechanisms.

-

Intellectual Property (IP) Documents: If applicable, have patents, trademarks, or copyrights ready to show that you've protected your unique ideas.

-

Partnership Agreements: If you have co-founders or partners, showcase agreements that outline roles, responsibilities, and revenue-sharing arrangements.

-

Financial Statements: Prepare clear and concise financial statements to show your current financial health and projections.

Understanding term sheets and funding agreements

Investors often present term sheets that outline the details of the proposed investment, including each party's rights. Understanding these documents is critical:

-

Valuation: Familiarize yourself with how your startup is valued and what it means for equity dilution.

-

Investment Amount: Know exactly how much funding you are seeking and how it will be utilized in your operations.

-

Exit Strategy: Be prepared to discuss exit options that align with investor expectations, such as acquisition or IPO scenarios.

Importance of transparency with investors

Building trust with your investors is paramount. Transparency can lead to stronger relationships and ultimately encourage investment. Here’s how you can maintain transparency:

-

Clear Communications: Be upfront about your startup's challenges and risks. This honesty fosters a sense of partnership rather than a client-vendor relationship.

-

Regular Reporting: Ensure that you provide investors with regular updates on your startup's progress, including successes and setbacks.

-

Show Willingness to Adapt: Demonstrating your willingness to adjust your strategies based on feedback can further cement trust.

By ensuring that all legal documents are prepared and that you approach transparency in your dealings, you align with the preparation tips for startups looking to pitch for funding opportunities in India. This meticulous attention to detail can set you apart as a reputable and credible entrepreneur in the eyes of potential investors.

For further guidance on legal documents and requirements, consider visiting LegalZoom, a resource for business legal documents and services.

Key Takeaways for Pitch Preparation

Successfully pitching your startup to potential investors requires thorough preparation, a solid understanding of your market, and effective delivery. In this final section, we'll summarize the crucial takeaways that can enhance your chances when seeking funding opportunities.

Summary of must-do preparation tips

To create an impactful pitch, follow these essential preparation tips:

-

Know Your Audience: Research and understand the investors you're pitching to. Tailor your pitch to align with their interests and investment strategies.

-

Craft a Compelling Pitch Deck: Ensure your pitch deck is professional, concise, and visually engaging. Include all key elements such as market opportunity, competitive analysis, and financial projections.

-

Develop a Strong Business Model: Clearly define your value proposition and revenue model. Showcase how your startup will differentiate itself in the marketplace.

-

Practice Your Delivery: Rehearse multiple times to build confidence. Practice in front of peers and be open to constructive feedback.

-

Prepare for Investor Insights: Anticipate the questions investors may ask and prepare data-backed answers. Be ready to discuss industry trends and how they affect your startup.

-

Foster Investor Relationships: Network strategically, follow up after meetings, and keep investors updated on your progress to build long-term relationships.

-

Stay Organized Legally: Have all necessary legal documents prepared to demonstrate professionalism and transparency, making it easier for investors to invest in confidence.

Final thoughts on creating a successful pitch experience

Always remember that the fundraising journey is a marathon, not a sprint. While securing investment can be challenging, adhering to these preparation tips for startups looking to pitch for funding opportunities in India will better position you for success. Approach each interaction with investors as a valuable learning experience, and stay open to feedback and iterations that might enhance your business model.

Additionally, consider exploring resources that offer guidance on pitch preparation, such as Y Combinator, which provides valuable advice for startups looking to refine their pitches and connect with investors.

What are the key elements of a successful pitch deck?

A successful pitch deck typically includes a clear introduction, an outline of the problem your startup solves, a description of your solution, market opportunities, your business model, financial projections, and details about your team. Each slide should be visually appealing and succinct, using graphics to illustrate points while maintaining clarity.

How can I identify the right investors for my startup?

To identify the right investors for your startup, research their investment history, focus areas, and preferred funding stages. Explore platforms like LinkedIn and Crunchbase to find investors who align with your industry and business model. Networking at industry events and seeking introductions through mutual connections can also help you connect with potential investors interested in your space.

What should I expect during the Q&A session with investors?

During the Q&A session, expect investors to ask probing questions about your business model, market size, competition, and financial projections. They might also question your team’s expertise and your startup's scalability. Be prepared to provide clear, data-driven answers and demonstrate a deep understanding of your business and industry dynamics.

How can I improve my pitch presentation skills?

Improving your pitch presentation skills involves practice and feedback. Rehearse your presentation multiple times, ideally in front of a diverse audience who can provide critical feedback. Consider joining a public speaking group or taking workshops designed to enhance presentation skills. Watching recordings of successful pitches can also offer valuable insights into effective delivery.

Why is transparency important when pitching to investors?

Transparency is crucial in the investor-pitch relationship as it builds trust and credibility. Investors appreciate honesty about your startup's challenges, risks, and progress. Being upfront about potential issues shows that you are knowledgeable and prepared for setbacks, creating a stronger impression and fostering a positive long-term relationship with investors.